OneCode Work From | Home Online Application

Lakhs of cheerful clients have viewed OneCode as the best work from home India and a web based procuring application that turns out a revenue with zero speculation. The best application for individuals who are searching for telecommute occupations on the web and wish to sell monetary items on the web and bring in cash up to ₹ 50,000.

Sell monetary results of brands like Kotak Bank, HDFC Bank, Paytm, Kredit Bee, Upstox and a lot more well known and dependable brands and acquire from home.

Joblessness has been on the ascent since the time the pandemic struck and it has impacted the occupations of many individuals. With the assistance of OneCode, you can bring in cash online with practically no problem. Produce pay at home and acquire through your side work.

Why Choose Us?

• Become confirmed monetary item vender: Join our normal preparing and get ensured to sell items across different classifications, for example, Demat accounts, charge cards, financial balances, credits, protection and considerably more. Figure out how to offer, who to offer to and which items to browse deals specialists

• Brought together dashboard to follow income: Track every one of your deals and profit on a solitary dashboard. No requirement for extra archives and bothers

• Installment Guarantee: Get ensured installment consistently for all your legitimate deals

• Admittance to 50+ items: Access 50+ results of famous brands on one single stage. Begin making deals and acquiring from an assorted scope of items

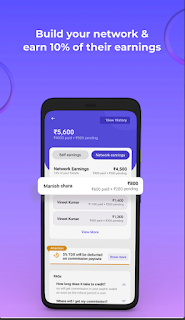

• Network Earnings: Add more individuals to your organization and acquire 10% of their profit each time they make a deal. Assemble your easy revenue by adding an ever increasing number of individuals to your organization and acquire online at home.

Elements of the App:

• Get prepared by specialists in Hindi, English and Telugu to sell monetary items and further develop your abilities

• Create prompts make deals effectively and make your online work simpler

• Track your profit helpfully through the application

• Allude different items like Life Insurances, Debit or Credits cards, Savings Account, Demat Accounts and bring in cash through your companions

• Deal with your deals and monitor your income on the actual application

• Get an itemized outline of your forthcoming and credited installments

• Make your own site to create leads and produce deals

Various Categories to Choose from:

• Charge cards

• Advances

• Demat Accounts

• Protection

• Financial balances

• Wallets

• Credit Builder

• Purchase Now Pay Later

what's more a lot more items to look over!

How might you go along with us?

Follow these five simple tasks to begin acquiring with OneCode

Click Here To Download Application

1. Download the OneCode application

2. Join utilizing your telephone number and complete your KYC

3. Accept your ID Card and Offer Letter.

4. Go to OneCode preparing to find out with regards to the various elements and elements of the stage. Likewise, find out with regards to various item classifications and brands.

5. Find out with regards to brands and begin offering the items to your organization!